Business Description

For sale is a 13-year-old upstate New York-based business that imports pet safety transportation systems and accessories. They sell through dealers and directly to consumers through their website (more than 86% of consumers and dealers purchase online, so the company is almost exclusively eCommerce).

This exclusive agreement with the manufacturer (supported by written agreements) guarantees the quality and integrity of their product line and allows them to maintain a consistent and reliable supply for customers.

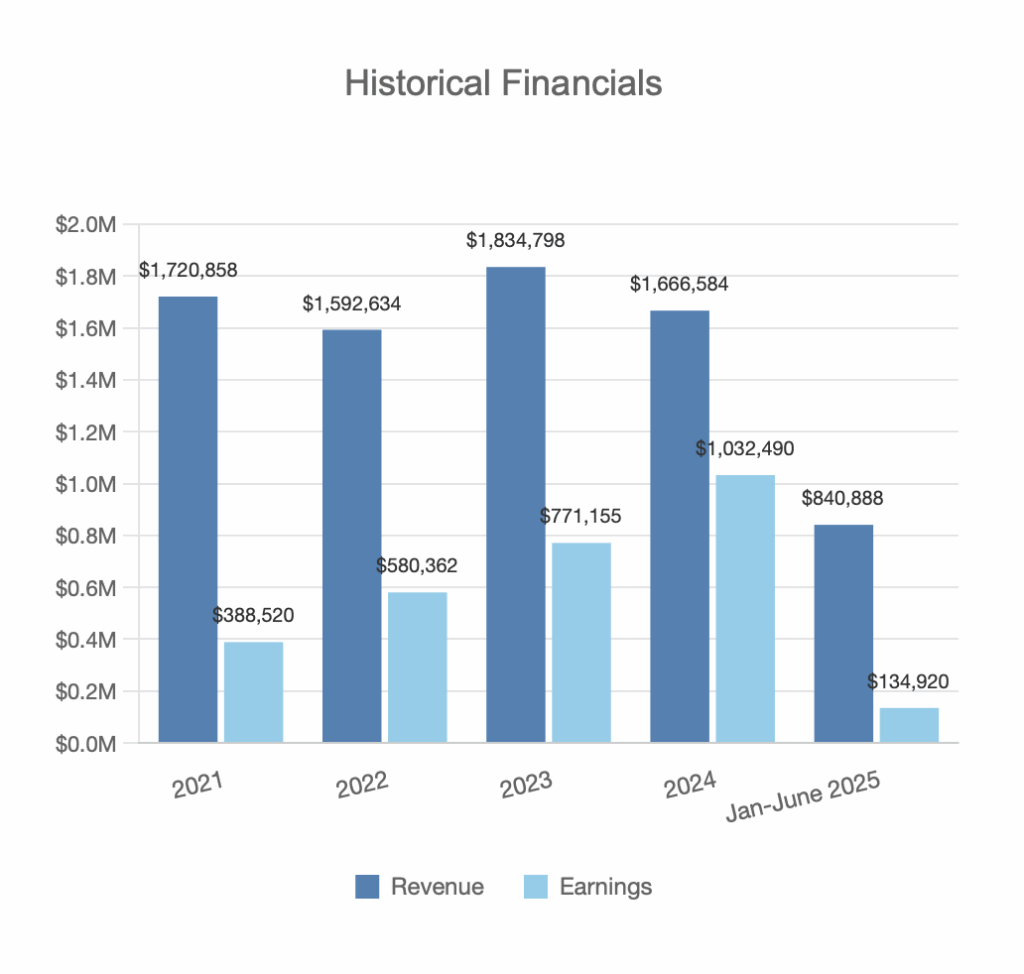

In 2025, the company strategically purchased sufficient inventory to sustain operations through 2026 in anticipation of tariff implementations. While this approach reduced profitability during the first two quarters, the benefits will be realized in Q3 and Q4, which represent the company’s peak sales periods. Management projects that 2025 revenue and profit will surpass 2024 performance by 10-15%. This positioning provides buyers with a stable, risk-free first year while establishing the foundation for 3-5x growth in revenue and profits over the following three years.

All tariff-related concerns have been resolved through negotiated agreements, providing operational certainty for prospective buyers. The company’s manufacturing operations and product imports remain insulated from trade-related disruptions. Tariffs on aluminum and steel apply exclusively to raw materials rather than finished goods, resulting in minimal impact on production costs, retail pricing, and profit margins. The company has secured tariff exemptions with its manufacturing partner, eliminating tariff expenses to date.

Additionally, a restructured partnership agreement extending 10-12 years from 2025 has been executed with enhanced terms that strengthen the company’s value proposition for potential buyers. This long-term manufacturing partnership ensures supply chain stability and reinforces the company’s competitive market position.

78% of the business is direct to consumers and 22% to wholesalers (with the typical margin to dealers being 38%). The three existing full-time staff members and the owner would be excited to continue to be part of the business. They are looking to sell to a buyer who can help provide strategic support and resources to facilitate the company’s growth and expansion.